An Effortless FinCEN BOI Filing Solution for Attorneys and Law Firm

Manage your client’s CTA compliance with our platform and add a new revenue stream for your business.

Book a DemoEasy

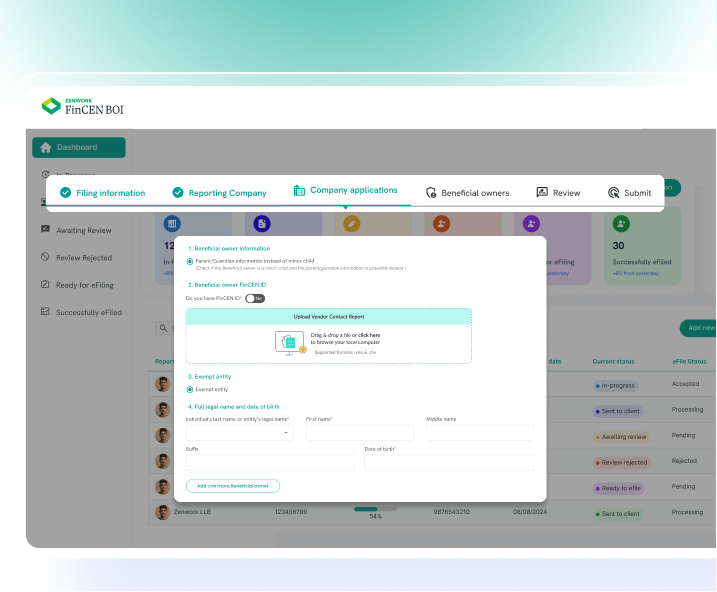

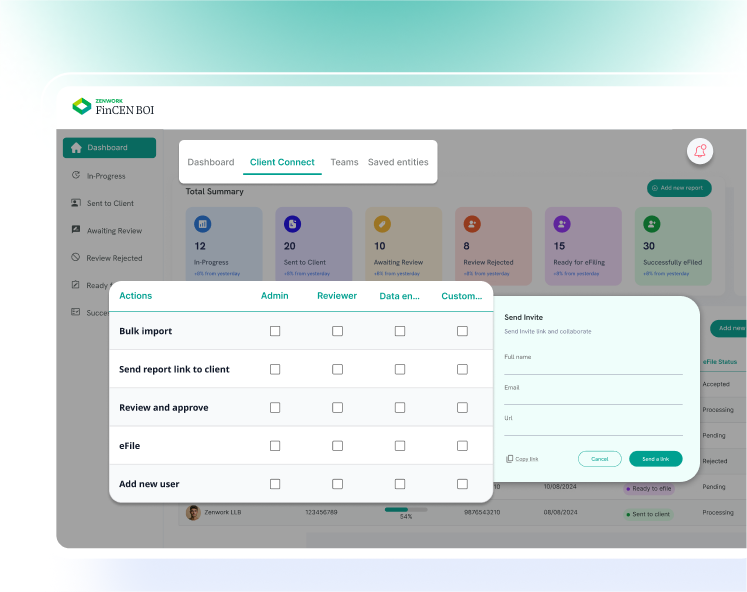

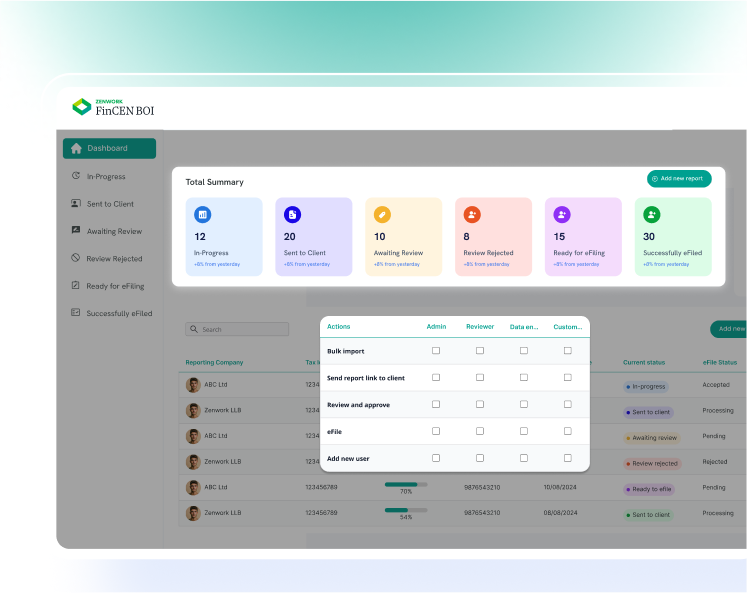

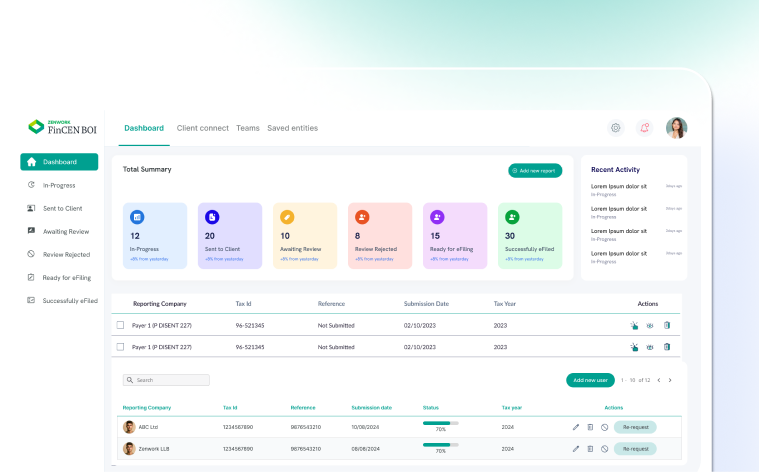

Manage thousands of reports effortlessly in a single dashboard from your existing platform or website.

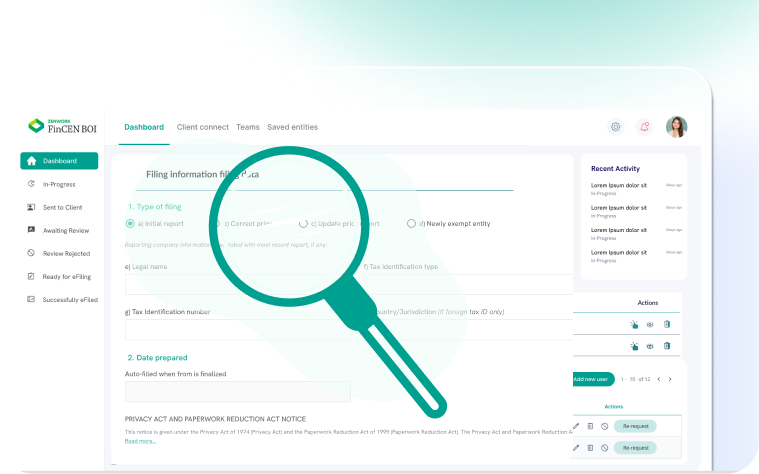

Accurate

Ensure precise and complete BOI reporting for Clients or Customers with our reliable solution.

Compliant

Avoid fines and stay ahead of regulatory requirements with our regular alerts & notifications.

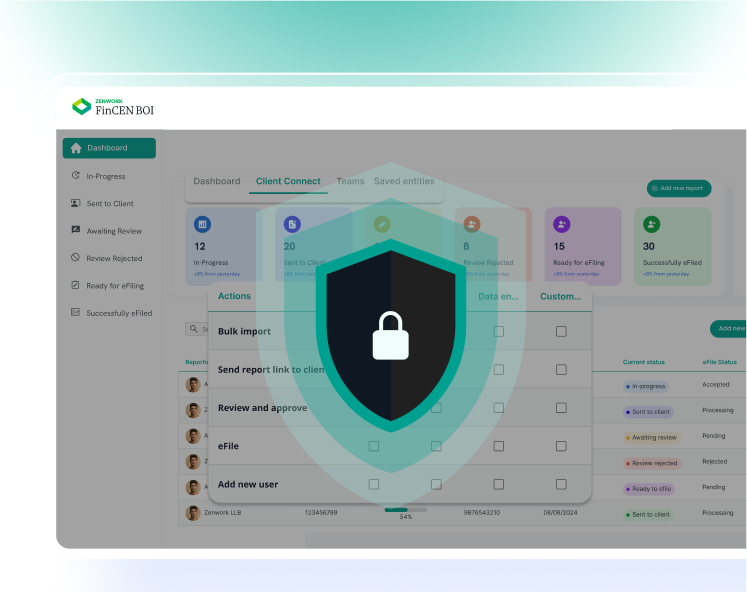

Secure

Protect sensitive information with our secure, SOC-2-certified BOI Filing platform.